December Newsletter

A monthly round-up of angel investment opportunities to help fund climate startups, featuring Azul Bio and Terrament.

Welcome to this edition of the New Wave Angels newsletter! This newsletter aims to amplify the success of climate entrepreneurs and small-check investors by promoting angel investment opportunities, knowledge-sharing, and networking. To learn more, subscribe.

I’m committed to keeping my content available for free to all subscribers. Here are a few ways to help sustain the newsletter and keep it accessible: become a paid subscriber, post a community classified, or sponsor a newsletter.

My process is driven entirely by investor engagement, so please be sure to reach out directly if there’s a company you’d like to learn more about. Once enough interest is generated for a given opportunity, I’ll gladly spin off an SPV!

Today is Giving Tuesday! Visit Giving Green to explore rigorously researched and carefully vetted climate non-profits that might not be on your radar. They recommend transformative giving opportunities that change laws, norms, and systems, so you can maximize the impact of your donations.🌱

This month’s newsletter is brought to you by Renew VC, a venture firm that produces excess returns for investors and changes inefficient, ineffective, and exclusionary systems for better outcomes. Their community of founders and investors is united in the beliefs that companies generating impact at scale represent one of the biggest investment opportunities in VC, and ignoring companies led by women, overlooked, and excluded founders is VC’s biggest recurring investment error. Sound like you? Get involved by taking the Purpose Pledge, tuning into their podcast Founded On Purpose, and learning more.

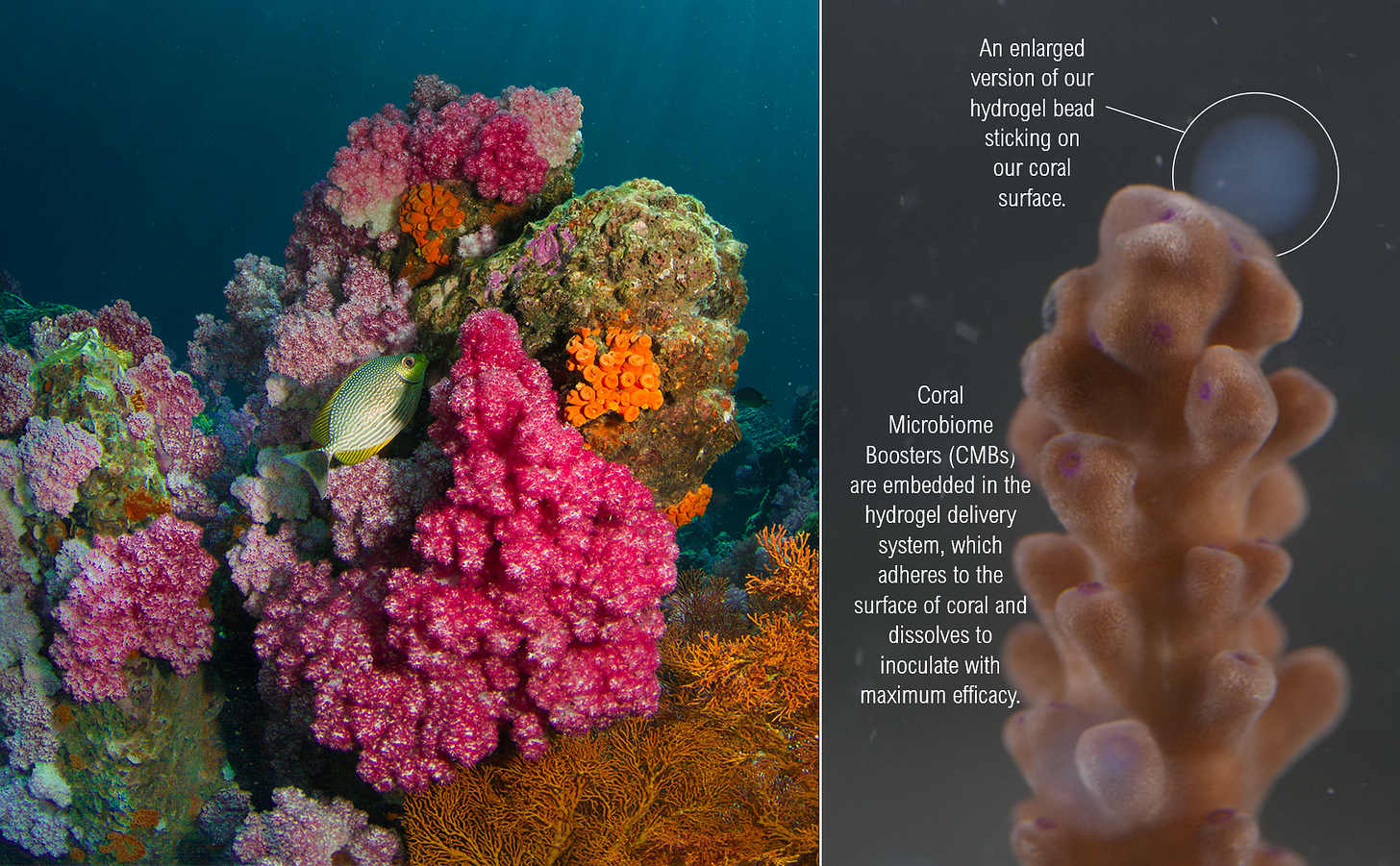

Azul Bio

Coral reefs are vital to our ocean and economy. Ocean warming has caused the death of 50% of reefs and will wipe out 90% by 2050. Azul Bio offers Coral Microbiome Boosters— effective, fast, and scalable marine preservation for risk mitigation.

Why we’re excited:

Coral reefs support 25% of ocean life, provide income and nourishment for 1B people, and generate $375B annually from tourism and fishing. Coastal businesses rely on reefs for tourism and storm protection.

Azul Bio uses natural microbial communities to create coral microbiome boosters—similar to our gut microbiome—that combat climate change, marine diseases, and pollution to enhance the health of ocean environments.

Traditional restoration efforts are slow, infrastructure-intensive, and hindered by ocean warming, with repopulated corals often lost to summer heat. Concrete seawalls and erosion barriers are costly, harmful to the environment, and disrupt oceanfront views vital for resorts.

Azul Bio's CMBs are mass-produced in bioreactors to quickly boost heat tolerance in fully-grown coral colonies and nursery corals, addressing critical environmental challenges that traditional restoration can't solve.

The visionaries:

Founder & CEO Benjamin Alva is a cellular and molecular bioengineer whose work has focused on developing tools to understand and engineer microbial communities. He has worked at NASA Ames Research Center, premier academic institutions, and previous startups.

Co-Founder & COO Aleksandr Rikhterman is an Emmy-winning documentary filmmaker and a PADI divemaster on a mission to preserve coral reefs, leveraging his global experience, passion for conservation, and over 200 dives.

With a total addressable market of $3.1B from 260,000 coastal properties, they've secured pilot agreements with a Bermuda property developer ($60k), are in talks with Hyatt for a pilot in the Maldives ($80k), and several public sector organizations.

Azul Bio recently won the Pitch Competition at The Fourth Effect’s Annual Summit 2024 for their work protecting ocean biodiversity at scale.

They’re currently accepting angel investors. For an intro, more information on investing, or to express interest in an investor event, please respond to this email.

Terrament

Terrament is building low-cost, high-scale energy storage using modular gravity batteries installed deep underground. Their patented design achieves 20 times more energy density than other gravity solutions by maximizing both height and weight.

Why we’re excited:

As our power grid adapts to the intermittency of renewable energy, the market faces an accelerating demand for long-duration energy storage. Governments and energy utilities alike are seeking new solutions to scale faster and cheaper.

Competing solutions, such as compressed air, flow batteries, and pumped hydro, face efficiency, scalability, or cost issues (e.g., Lithium-ion batteries are too expensive at long durations, and pumped hydro is a nearly tapped-out resource). Terrament offers a viable solution that is low-risk, high-scale, and low-cost.

Their patented design maximizes height with proven mining technology that drills a mile deep. Then, it maximizes weight with a proprietary modular conveyance system bolted to the bedrock of the shaft wall.

Their first customers are energy utilities and independent power producers seeking solutions to replace decommissioned coal or gas plants, reduce pollution by replacing peaker plants, lower renewable energy costs, and defer HVDC transmission upgrades.

The visionaries:

Eric Chaves is a technical entrepreneur with 20 years experience in Architecture, Industrial Design, and Software Engineering. Terrament is his third company. He’s been awarded a US Patent and has two more pending patent applications.

Terrament has been accepted into the following programs: CEBIP accelerator program at Stony Brook University (since 2021), Founder Fellowship cohort at Newlab (in 2023, still active), Plug and Play Program (Japan - Energy focus, in 2024), and Clean Tech Open Program (Northeast, in 2024). Terrament was also a recipient of the U.S. DOE EnergyWERX voucher grant.

Check out this 2-minute highlight from an interview with Eric:

They’re currently accepting angel investors. For an intro, more information on investing, or to express interest in an investor event, please respond to this email.

Interested in past opportunities? It‘s not too late to reach out!

Before we dive into our main monthly topic, a quick note on holiday shopping We've officially entered the holiday season! If you're anything like me, you've spent the last couple of weeks trying to change your Black Friday shopping habits. Netflix recently released a documentary called Buy Now: The Shopping Conspiracy, featuring one of my favorite climate influencers and advocates, Anna Sacks, The Trash Walker. It's a great watch and serves as a timely reminder to gift sustainably this year.

As for my own approach, here are a few strategies I love: gifting experiences over things, shopping locally, considering Substack subscriptions or donations (or even angel investments!) on someone's behalf, and prioritizing sustainable brands over fast fashion and big-box stores. To wrap it up, make your holiday season a little greener and a lot more thoughtful by prioritizing quality and sustainability.🎁

How Endless Streamlined Their SPV Process with Sydecar

I met Siobhan Frost, Co-Founder and CEO of Endless, through HeyMama, a networking group for working mothers. We quickly discovered a mutual connection with Annie Evans of Dream Ventures. Annie, along with Kelley Arena of Golden Hour Ventures, forms a powerhouse duo for connecting female founders with aligned investors. Through conversations with them, I came to appreciate the many benefits of Special Purpose Vehicles (SPVs).

While I could list all the reasons I love SPVs, no one puts it better than Kelley: “It’s not just angel investing, it’s a movement.” Kelley explains that SPVs allow investors to start their journey with as little as $1,000. More importantly, they offer "a bottom-up, community-focused approach to create a more equitable landscape” and create “a village of invested ambassadors” that founders can rely on.

To raise capital through an SPV, Siobhan and her team hosted an incredible virtual investor pitch event, engaging a large pool of small-check investors, including myself. (They also followed up with a write-up in my newsletter). Endless is developing an uncompromising sunscreen product packaged in design-led, biodegradable, and refillable packaging. With projections showing more plastic than fish in our oceans by 2050, I believe Endless has the potential to shake up the sunscreen industry in the coming decades.

Siobhan used Sydecar, my favorite SPV management platform, to manage her SPV. After the pitch event, she followed up with an email that included the pitch materials, investment instructions, and details of the round, such as allocation amount, minimum check size, valuation, and SAFE (Simple Agreement for Future Equity) note terms. With just a few clicks in Sydecar, I easily funded my investment. I verified my relationship with the fund manager (the person responsible for setting up and managing the fund on Sydecar—Siobhan, in this case), confirmed my accredited investor status, selected my investment amount, and entered my wire transfer information.

What I love about Sydecar is how it simplifies the investment process. Once my bank transfer was complete and the SPV closed, I sealed my position as an angel investor. Now, I await updates from the founder (or fund manager), knowing I have a streamlined, easy-to-use platform backing my investment. If an exit event occurs, the fund manager will distribute the proceeds based on each investor’s ownership stake in the SPV, and I can access my share through my Sydecar account.

In this case, Siobhan, the CEO of Endless, took on the responsibility of managing the SPV, but that’s not always the case. Often, the CEO will appoint a separate fund manager, who charges a small management fee, to oversee the SPV. For example, Kelley and Annie have been using SPVs for years to support women-led companies while also educating new investors, and at New Wave Angels, I share a similar goal in the climate space. Overall, SPVs offer an accessible, efficient way for impact investors to support companies with missions that resonate, and I’m excited to continue creating these opportunities.

Reminder: My process is driven entirely by investor engagement, so please be sure to reach out directly if there’s a company you’d like to learn more about. Once enough interest is generated for a given opportunity, I’ll gladly spin off an SPV!

Hey, I'm Caitland, a senior copywriter and content strategist with proven experience telling stories for clients in B2B SaaS, skincare, e-learning, and more. Now, I'm bringing these proven tactics to climate, food, and sustainability spaces. When I'm not writing, you'll find me at the community garden. Let’s chat! Reach me at conleycreativestudio@gmail.com.