October Newsletter

A monthly round-up of angel investment opportunities to help fund climate startups, featuring Lillian Augusta Beauty and Nū Data.

Welcome to this edition of the New Wave Investment Club newsletter! This newsletter aims to amplify the success of climate entrepreneurs and small-check investors by promoting angel investment opportunities, knowledge-sharing, and networking. To learn more, subscribe.

This month's newsletter is sponsored by the LEO Impact Fund, the student-run impact investing fund at Columbia Business School, focused on supporting innovative social enterprises that drive social and environmental impact on a global scale. Do you want to know more about the LEO Impact Fund? Read further below!

Lillian Augusta Beauty (LAB)

Experience hair without harm with Lillian Augusta Beauty (LAB). Their premium plant-based braiding hair provides a sustainable alternative to synthetic braiding. Their hair is plastic-free, irritation-free, and carcinogen-free.

Why we’re excited:

Synthetic braiding hair is used primarily by Black women, who have been left with the worst materials when creating their unique and beautiful hairstyles. 42% of those who use synthetic braiding have experienced some discomfort.

Legacy brands rely on heavy plastics and allergens, while contemporary brands often use dyes that leach, fibers that carry odors, or plastics in their ingredients.

While most braiding hair is made from plastic, resulting in 98 million pounds of plastic pollution each year, LAB’s plant-based braiding hair is compostable.

LAB’s braiding hair outperforms synthetic options in performance, comfort, environmental sustainability, and health consciousness, positioning the brand favorably within the $2.5 billion Black hair care industry.

The visionaries:

CEO Jannice Newson is a University of Missouri and University of Michigan alum, Carbon180 Entrepreneur in Residence, US Dept. of Energy NREL Labstart Fellow, Enterprise for Youth Climate Career Corps Board Member, and has been featured in Girls Who Green the World by Diana Kapp.

LAB started in the lab at the University of Michigan. Their team has expertise in environmental science, CPG marketing, textiles, and braiding and has already received funding from McDonald's, the University of Michigan, and Cummins.

Join their upcoming events!

October 17th: FLEUROTICA spotlights the unique talents of Chicago’s leading floral designers, fashion designers, students, and landscape artists as they create breathtaking garments made entirely from plants, flowers, and natural materials.

October 21st: Stylist Series with LAB and Bisi Blvd in Chicago Join Lillian Augusta Beauty (LAB) and Bisi Blvd for an afternoon of spirited discussion on braiding service and entrepreneurship. Lunch will be served. RSVP

October 28th: Science and Sustainability: The Hair and Beauty Way Join Lillian Augusta Beauty (LAB) in a panel discussion on where science and sustainability find their roles (or don't) in the hair and beauty industry.

They’re currently accepting angel investors and investments on WeFunder. For an intro to the founder, more information, or to express interest in an investor event, please respond to this email.

Nū Data

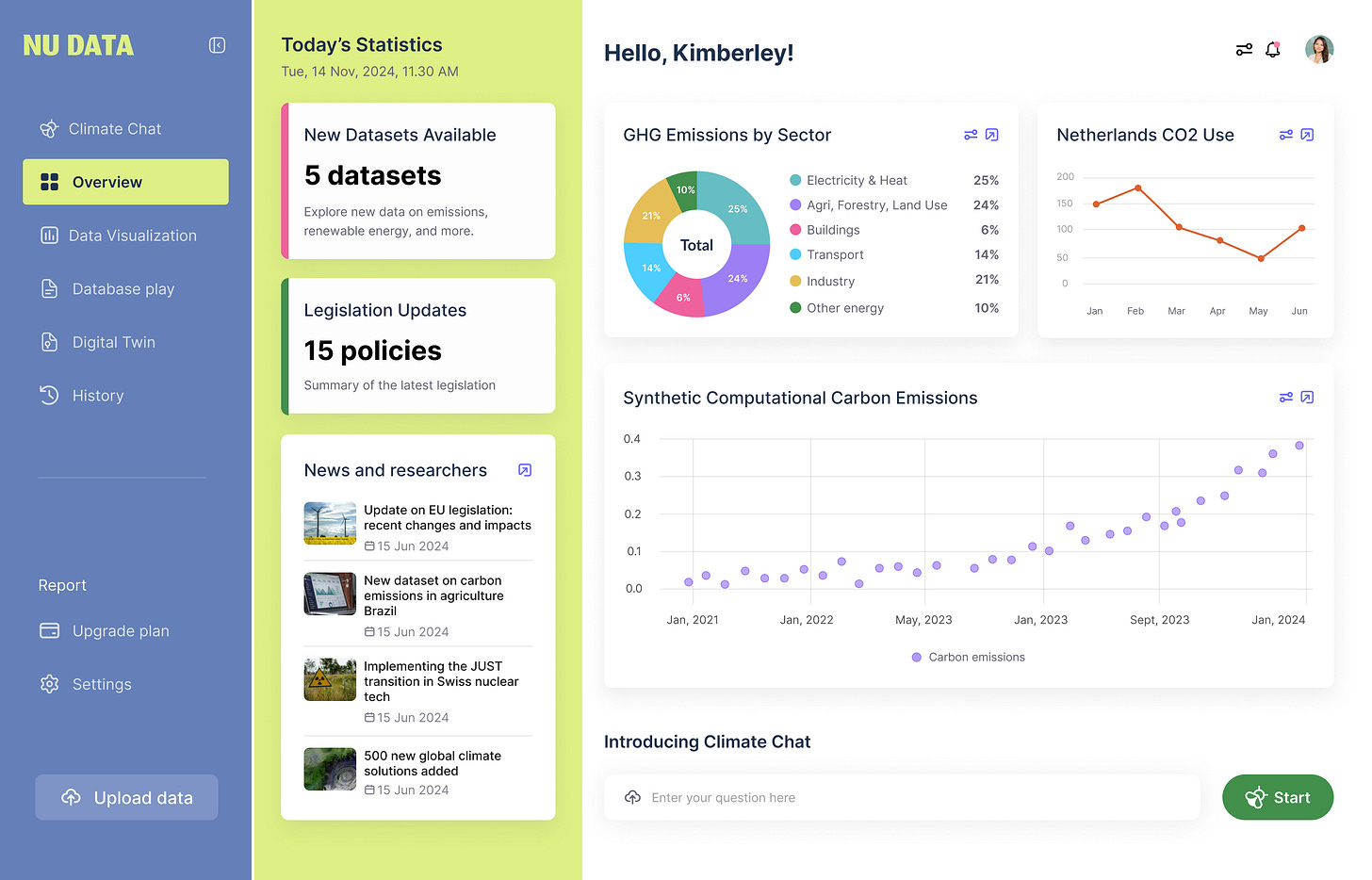

Nū Data enables effective risk and opportunities assessment for climate adaptation and mitigation by providing easy-access to high-quality data through their platform, designed to support business stakeholders, policymakers, researchers, consultants, and investors.

Why we’re excited:

Powered by Generative AI and ML, Nū Data is a cleaned, cataloged, and maintained collection of trusted resources for sustainability for experts and non-experts alike.

Their proprietary framework and synthetic data generation allow users to test decisions and strategies in a sustainability digital twin or ‘play environment’ that mirrors the current socio-political and economic environment before real-world implementation, reducing risk.

While their competitors only focus on data aggregation, Nū Data guides users through the climate action aspect with recommended action, partners, and resources that empower organizations, policymakers, financiers, and governments to take confident and urgent climate action.

Their models use sustainability reporting standards (e.g., GHG, CSRD, CDP, and more), recognized frameworks, scientific metrics (e.g., JUST Transition, ESSF, Planetary Boundaries), pending and passed legislation, current affairs, socio-economic markers, and more to make customized recommendations.

The visionaries:

Nhi Corcoran, founder and CEO, is a serial entrepreneur with 6 ventures under her belt and expertise in marketing, commercialization, research, behavioral science, brand journalism, and creative work.

Nhi will join as a speaker at The Greenhouse this fall as part of their initiative to bring together female founders making climate efforts. She recently joined Climate Hack in Amsterdam as a partner in their latest event on urban resilience.

She’s currently accepting angel investors. For an intro to the founder, more information, or to express interest in an investor event, please respond to this email.

Interested in past opportunities? It‘s not too late to reach out! PolyGone, featured in August, just held the grand opening of their Microplastic Removal Pilot at the Atlantic County Utilities Authority (ACUA). Watch a video of the grand opening here. 👀

What To Look For In An Investor Pitch Deck, featuring Vanessa Halik, CEO of Another Tomorrow

My latest angel investment is in Another Tomorrow. Driven by a clear vision, Another Tomorrow is leading the future of fashion as the best-in-class circular, sustainable luxury brand with platform ambitions. I sat down with their CEO, Vanessa Halik, to discuss their impressive investor pitch deck. In our conversation, we explored her thought process behind specific slides, and I shared my insights as an angel investor on what made them so compelling and why I wanted to invest. Note: this is a small sampling from her much larger investor deck.

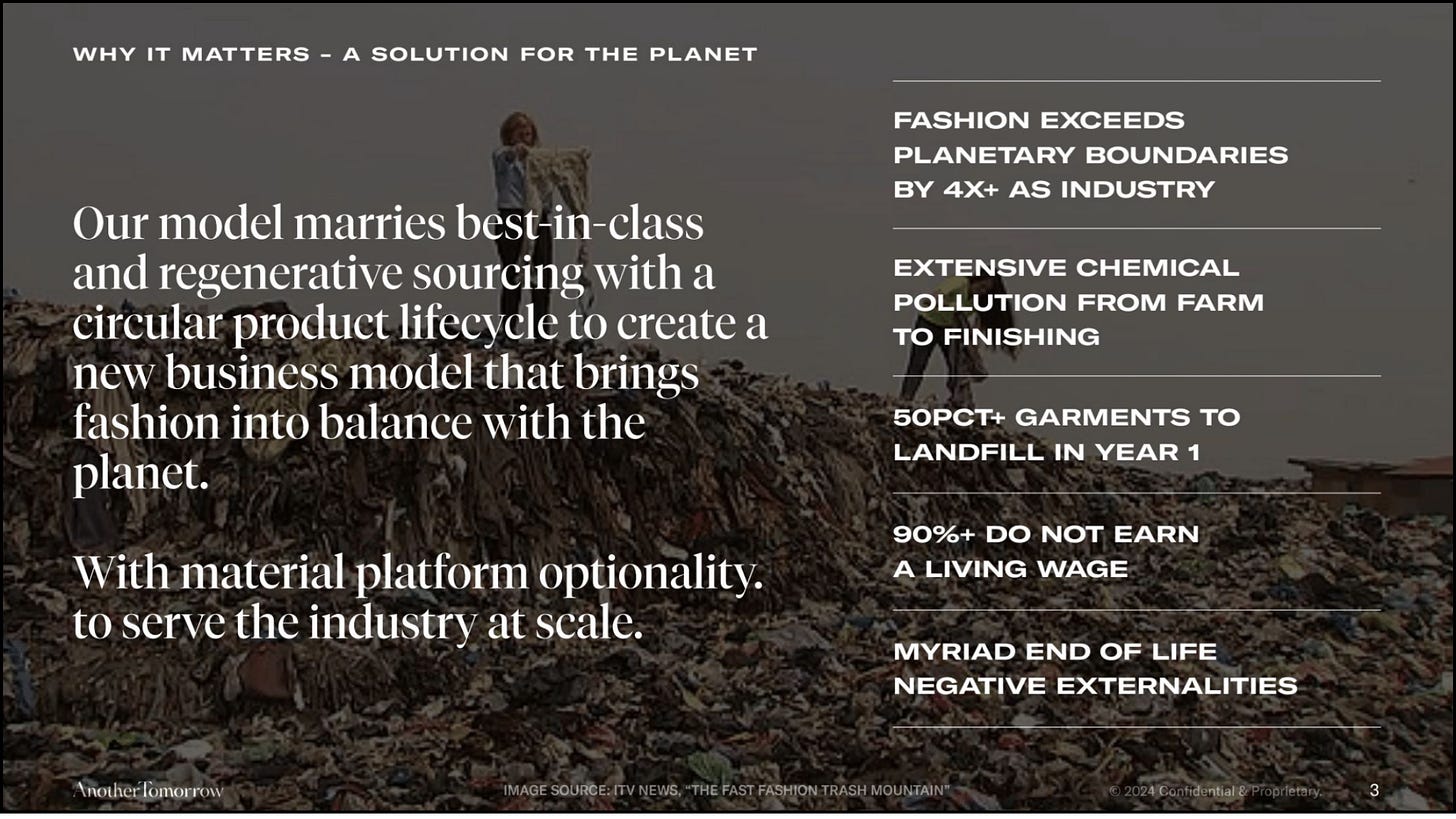

Clear Problem Statement

When investing, I focus solely on companies that intend to make a positive environmental impact alongside financial returns. As someone who's always enjoyed fashion and personal style, it pains me to know it's one of the largest polluting industries globally. Your pitch deck clearly articulates the problem your company addresses from the perspectives of your customers, the industry, and the planet. For me, this helped reinforce the urgency and relevance of Another Tomorrow’s solution.

Vanessa — I lead with this slide early in the deck as it addresses “why does this company need to exist,” a crucial question in deciding whether to fund anything. Providing a scalable solution to the environmental and social issues in fashion is central to our mission. However, the issues are highly complex and therefore this slide seeks to communicate both our solution and the high level challenges it addresses in a streamlined way.

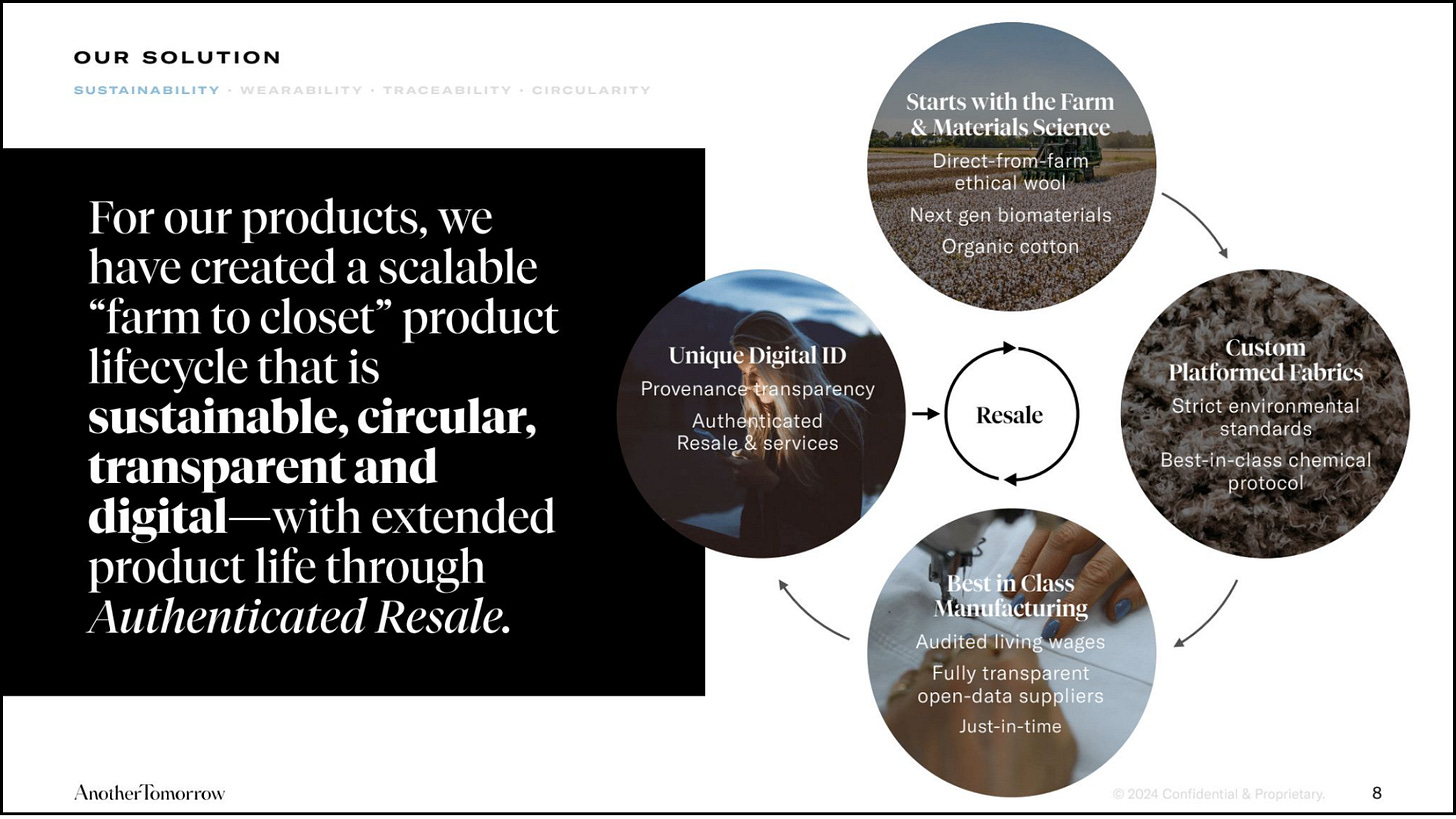

Solution Overview

This slide offered me a concise explanation of Another Tomorrow’s unique value proposition and benefits. The deck outlines how the company’s products and services tackle the issues associated with fashion production through four pillars: sustainability, wearability, traceability, and circularity. Your solution overview effectively guided me through the entire product lifecycle—from the materials and manufacturing processes to the transparency during purchasing and extending the product’s life through authenticated resale services. I walked away from this investor pitch with a clear understanding of Another Tomorrow's mission in the fashion industry.

Vanessa — I am thrilled to hear it. It is key that investors understand the way we operate as a full system early on in the pitch - particularly as we are now scaling some of these solutions B2B, which we move on to explain later in the deck. We iterated on this slide several times and found this product lifecycle to be the most effective and elegant way to articulate this to a diverse audience of potential investors.

Market Opportunity

As a buyer, I am drawn to and actively seek out brands that emphasize substantial, long-lasting purchases—such as personal luxury over fast fashion—and those that incorporate resale models. (Resale is a great way to justify more significant purchases, turning your closet pieces into assets.) As an angel investor, I look for a “standout returner” with significant growth potential. To validate the demand for these values beyond my personal preference and to confirm the opportunity for substantial growth, I want to see compelling data on market size, target audience, growth projections, and existing partners.

Vanessa — What I love about this slide is the way it demonstrates that we are operating in a market that is already compellingly large and growing, while underscoring the remarkable tailwinds that support our potential for outperformance given opportunity to take share and leverage demographic and cultural trends supporting circular economy based solutions.

Vanessa is a prominent voice on innovation, digitalization, and new business models with a strong emphasis on circularity. Her work has been featured in The NYTimes, Fast Company, Bloomberg, Forbes, and Vogue. Check out Another Tomorrow’s Retail Website, and watch for their flagship store coming to NYC this Fall.

Want to learn more about my investment journey? Schedule a call. Questions? Reply to this email or chat with me on Substack. I always reply.

More About our Sponsor

LEO Impact Fund (formerly known as Microlumbia) at Columbia Business School is a student-managed impact investment fund founded in 2007 as a 501(c)(3) nonprofit. Our mission is to educate the next generation of impact investors while supporting social enterprises that address critical global challenges. With over $150,000 in assets, we make debt investments in startups focused on financial inclusion, healthcare, education technology, and climate solutions.

Our latest investment (pending finalization) will be in an EdTech platform based in Chile that uses data-driven tools to prevent bullying and cyberbullying in schools. Our current portfolio companies include FORME – Educação Financeira, a financial literacy company based in Brazil, and Ilara Health, a company offering diagnostic and admin software to health clinics in Africa.

Are you excited about what LEO has to offer? Whether you are an individual investor, a company, or a student, we’d love to connect with you. Visit us at leoimpact.org or reach out to us via email at info@leoimpact.org to explore opportunities for collaboration or to learn more about supporting our fund.

Very informative & well-curated! Thank you for sharing

A question from one of our readers and an answer from Jannice:

How does/will the cost of the eco-friendly/compostable braiding hair compare to the cost of real human hair that some folks use if they don't want to go the synthetic route?

LAB braiding hair is less expensive than human braiding hair. Synthetic braiding hair can range from $2-$15, and human braiding hair starts around $60 and goes up from there. A more popular style this year, boho braids, uses cheaper human hair. However, the bundles sold for this style are not ideal for braids and are rather used as an add-in on top of synthetic braiding hair.