September Newsletter

A monthly round-up of angel investment opportunities to help fund climate startups featuring Jackalo, Project B, and Homegrown.

Welcome to this edition of the New Wave Investment Club newsletter! This newsletter aims to amplify the success of climate entrepreneurs and small-check investors by promoting angel investment opportunities, knowledge-sharing, and networking.

This month features Jackalo, Project B, and Homegrown. To learn more, subscribe.

Check out my newest article on ClimateSort: “20 Best Climate Tech Newsletters to Subscribe to in 2024”.

This month's newsletter is sponsored by Conley Creative Studio, a copywriting consultancy that helps small businesses and nonprofits stand out through evergreen copywriting. Explore their work here.

Jackalo

Jackalo is revolutionizing children’s fashion as the first circular kids’ clothing brand, merging eco-friendly materials and a buy-back program to create long-lasting, sustainable apparel.

Why we’re excited:

Jackalo’s clothing is designed to be handed down to the next kid or resold on their website. When clothes are outgrown, Jackalo will buy them back to be renewed and resold, or responsibly recycled.

Jackalo is the only children’s brand to offer a single checkout for new and pre-loved items, making the process a no-brainer for busy parents.

Knowing fashion is one of the largest polluting industries in the world, Jackalo only uses fabrics that can be recycled with today’s available technology or composted at the end of their usable life.

The circular fashion market is anticipated to be $700B by 2030. Jackalo is prepared to be the leading name in this space as the first circular kid's clothing brand. (There is no shortage of sustainable brands, but there is a shortage of brands that make circularity an easy choice for parents).

The visionaries:

Marianna Sachse is a mother, maker, and long-time environmentalist. She was named a 2023 Nasdaq Milestone Maker for her impact and participated in the prestigious Techstars Washington D.C. 2023 Cohort, often called the Harvard of accelerators. She was recently featured in HearstLab’s female founder spotlight.

They are currently raising a $200k angel round. For an intro to the founder, more information, or to express interest in an investor event, please respond to this email.

Project B

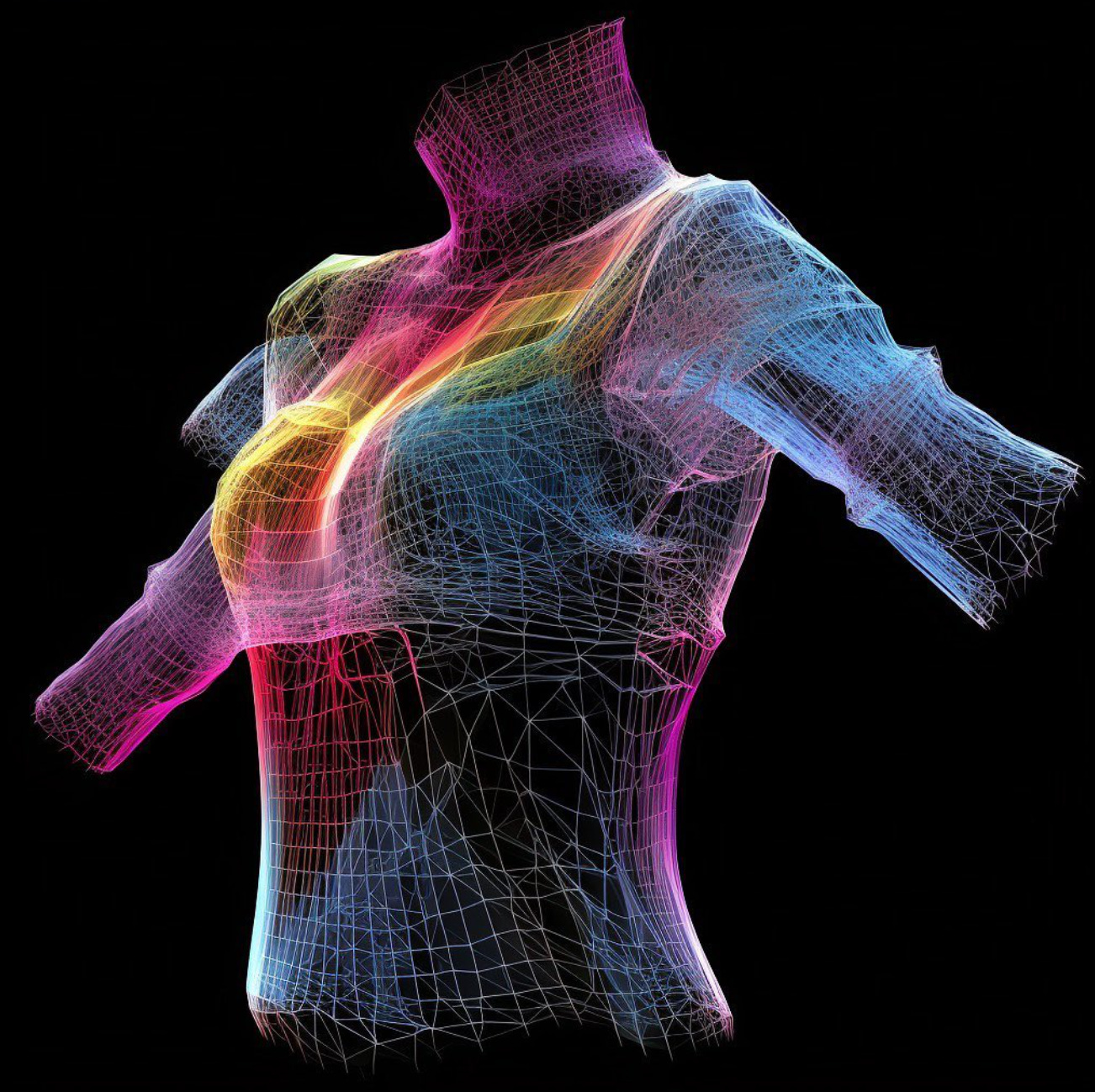

Project B creates custom-fit garments in minutes by combining phone body scanning, AI, and zero-waste on-demand 3D knitting. Their mission is to end overproduction in the fashion industry while providing the best shopping experience.

Why we’re excited:

Starting with bras as their first product, Project B aims to produce only the necessary number of garments in the exact sizes that will genuinely fit people, eliminating the 30% of garments that go unsold, unworn, or unused each year.

Unlike its competitors, Project B can make and deliver a custom-fit garment in less than a week. They guarantee a superior customer shopping experience by only requiring a 30-second scan using a smartphone.

Their process is highly automated, involves no textile waste, removes the guesswork from the customer, and offers a custom and personalized solution.

As they grow, they plan to expand their offerings to include swimwear, athletic wear, uniforms, and women’s apparel, tapping into the broader $1.5 trillion global apparel market and seeking opportunities to collaborate with established fashion brands to leverage their technology.

The visionaries:

Bella Baidak and Zain Abdelrazeq are a part of the Newlab 2024 NYC Founder Fellowship program. They were recently featured at The Wall Street Journal’s Future of Everything Festival and were awarded Cornell Tech’s 2023 Startup Award.

They're currently accepting angel investors. For an intro to the founder, more information, or to express interest in an investor event, please respond to this email.

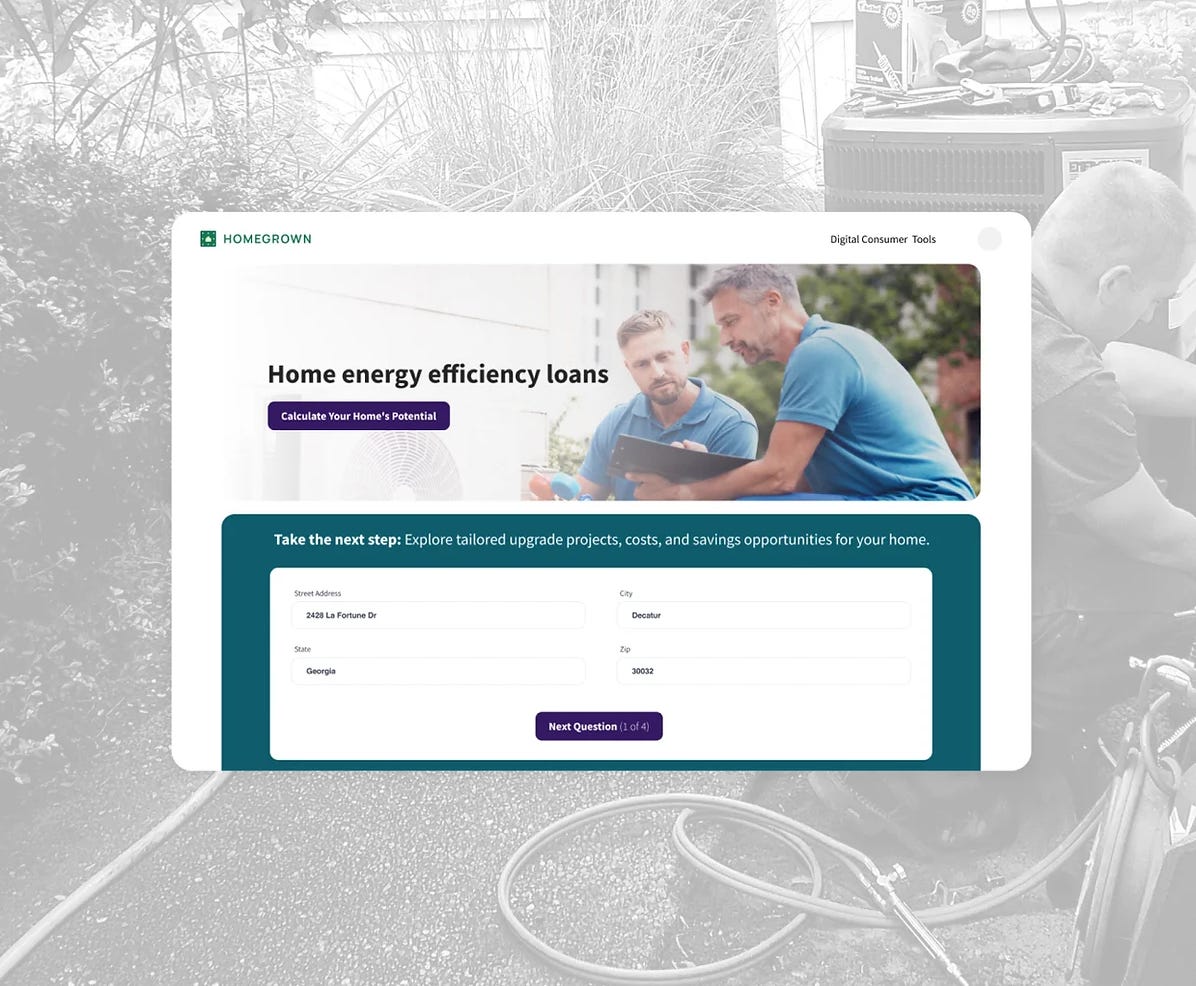

Homegrown

Homegrown is accelerating single-family decarbonization by powering smarter home lending and investing. They promote sustainable choices in mortgages, HELOCs, personal loans, private investments, and securitizations.

Why we’re excited:

13 million U.S. households are severely energy-burdened due to their monthly utility costs, and 20% of U.S. emissions are related to residential energy use.

Current financial lending and investment decisions often overlook home efficiency, energy costs, and carbon emissions. Homegrown believes that to decarbonize the 80 million U.S. single-family homes, financial stakeholders must develop sustainable, long-term products for consumers and investors.

Homegrown advocates for effective financial products to help Americans benefit from energy efficiency, particularly those in marginalized communities most vulnerable to climate change and increased energy costs.

Their machine-learning model integrates energy consumption and cost data directly into consumer lenders’ and investors’ existing business flows, enabling them to deliver energy efficiency benefits to their consumer customers.

The visionaries:

Sarah Patel, Kevin Ruane, and Kyle Ruane share a passion for decarbonizing single-family housing. Homegrown is the Finovate Fall 2024 Environment Scholarship winner, and Sarah and Kevin are joining Finovate Fall to discuss how home energy efficiency unlocks value for consumers and lenders.

They're currently accepting angel investors. For an intro to the founder, more information, or to express interest in an investor event, please respond to this email.

Our Guide to Angel Investing with Us

Assess your Financial Readiness

Angel investing involves funding early-stage startups in exchange for equity. Depending on the startup's appeal and valuation, investors typically invest $5k—$25k, while beginners may invest smaller amounts, such as $1-2k. Those looking to dive in should evaluate their financial readiness and risk tolerance first, as angel investing is extremely high-risk (you could lose your entire investment). I recommend choosing an annual budget and spreading it across 2-5 companies. Also, ensure you qualify as an accredited investor, as many angel opportunities require this. Unsure? Schedule a call.

Define Your Investment Goals

It’s important to define your investment goals upfront. My personal investment thesis is: “I invest in pre-seed and seed-stage companies in the U.S. that intend to generate positive social/environmental impact alongside financial returns.” This is a clear framework for evaluating investment opportunities. If a potential opportunity does not align with this, I quickly recognize it’s not for me. (It’s also my guiding framework for featuring investment opportunities in this newsletter).

Source and Evaluate Investment Opportunities

Connecting with angel groups provides a steady flow of investment opportunities. Stay informed by reading relevant resources (like this newsletter or any of these) and attend networking events. Need recommendations? Reply to this email. I handle the initial evaluation of opportunities featured in this newsletter, focusing on the founder, and facilitate further due diligence through investor events and our Substack chat. Our community helps assess business models and market potential. If interest is high, we may form an SPV managed through Sydecar to invest collectively and accommodate smaller check sizes.

Post-Investment

Returns on early-stage investments often take 5-10 years, sometimes yielding up to 10x returns, if at all, through successful exits. Angel investing is about finding that one standout returner among many investments. In the meantime, investors gain personal fulfillment and build connections by supporting startups through mentorship and networking. Investing with New Wave Investment Club includes invitations to think tank events and updates with founders. While not necessarily philanthropic, angel investing can have philanthropic aspects for those passionate about impactful startups.

I hope this short guide helps you start angel investing with us with confidence! Want to learn more about my investment journey? Schedule a call.

Questions? Reply to this email or chat with me on Substack. I always reply. Interested in past opportunities? It‘s not too late to reach out!

Continue Reading for An Interview with Hadleigh Swarts, Founder of The Unwash

The Unwash is a lifestyle and media site focused on sustainability and social impact. It offers brand reviews, sustainability news, and interviews. I worked with Hadleigh as a contributing editor, reviewing products like Rif Care, Davids Toothpaste, and Great Wrap. Check out The Unwash website and subscribe to their newsletter here.

What inspired you to start The Unwash, and how did your passion for sustainability play a role in that decision?

I’ve always had a passion for sustainability but when deciding to create this project, sustainability wasn’t the main focal point of my original ideations. A few years ago, I started making major shifts in how I was shopping. I was committed to making larger investments in my clothes, products, and even things like furniture to ensure that what I was purchasing would last me as long as possible. When thinking about making more substantial investments in how I spent my money, I was ultimately pondering who owns the brands I’m purchasing from and how they use their platform. I divested from brands that didn’t align with my values or brands that didn’t use their platform for larger change such as inclusivity, accessibility, policy issues, social impact, and of course environmental values. The largest common denominator ended up being sustainability. Sustainable practices ultimately became the baseline for brands I wanted to support. There weren't many platforms that were analyzing brands and the topic of sustainability through this all-encompassing lens. The goal was to fill this gap by finding brands that go above the benchmark of sustainable practices. In many ways, it's an antidote to greenwashing so that consumers can find trustworthy information before they make a purchase.

Can you describe how you select brands to feature on The Unwash? What criteria do you use to evaluate them?

Every brand featured on The Unwash goes through a deep vetting process. Myself or other editors research information that reflects a brand's ethos, transparency, and sustainability stats which is what our rating system is based on. This includes deep diving into founders, sustainability reports, messaging brands share, and even understanding a brand's funding. I try to leave no stone unturned. For example, if a brand of interest were acquired by a major billion-dollar conglomerate, it more than likely would no longer be the best fit for our site as we’re focused on brands that have a more localized impact. Overall, any brand featured on The Unwash is a great brand to support. We don’t feature any brands that aren’t worth a consumer's money, thus our vote-with-your-dollar mentality.

What has your fundraising experience been like as a founder, and what advice would you give to those, particularly women, who are entering the investing space?

Before I considered fundraising, I wanted to ensure that my mission and goals would remain unchanged if I were to raise capital. This led me through a path of extensive research. I met with as many founders, mentors, and individuals with fundraising experience as possible. Everyone approaches this process differently, and there isn’t a right or wrong way to do it, especially when you’re a woman and might not have the same doors open to you as men in this business. When it comes to my experience, a founder of one of my favorite brands sent me a list of over 100 accelerator programs, Venture Capital Firms, and Angel investors. This list led me to an innovations program that has set me up with a C-suite mentor in the media and marketing field to help The Unwash reach larger milestones with a faster turnaround. I think programs like this are great for solo founders, or female founders that need extra support to get their foot in the door.

Many women-owned companies are the ones really shaping the consumer landscape at the moment, and investors have the opportunity to match what consumers are wanting. We especially need more women, LGBTQ+, and BIPOC individuals behind the scenes who believe in diverse business owners and can provide business owners a platform for larger growth. I believe women in the investment space are especially important for brands in the ideation phase. Women have a pulse on creativity, trends, and what consumers want. Filling the fundraising gap by having more women get involved is a win across the board for investors and brand owners alike. Out of all of the meetings I had regarding investment, it was a woman investor who saw the potential in what I was doing. I can directly attest to and see the possibility for impact when it comes to diversifying this space.

Liz, this is so helpful — giving these brands a follow and absolutely *love* what The Unwash is doing editorially.